colorado estate tax form

Ad The Leading Online Publisher of National and State-specific Legal Documents. A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who.

Nationwide Tax Consultation Preparation Tax Accountant Tax Tax Services

Get Access to the Largest Online Library of Legal Forms for Any State.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

. DR 0158-F - EstateTrust Extension of Time for Filing. DR 0104EP - Individual Estimated Income Tax Payment Form. Pursuant to 39-3-1195 the personal property minimum filing exemption threshold exemption amount for tax years 2021 and 2022 is.

DR 0104PN - Part-YearNonresident Computation Form. DR 0253 - Income Tax Closing Agreement. DR 0104EP- Individual Estimated Income Tax Payment Form.

DR 1778 - E-Filer Attachment Form. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Form 104PN - Nonresident Income Tax Return.

DR 0104TN - Colorado Earned Income Tax Credit for ITIN Filers. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by. Application for Property Tax Exemption.

For Colorado returns the Fiduciary Income Tax Return is NOT used as a transmittal for the debtors form Individual Income Tax Return. A state inheritance tax was enacted in Colorado in 1927. DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing.

DR 0104CR - Individual Income Tax Credit Schedule. Even though there is no estate tax in Colorado you may still owe the federal estate tax. DR 0105 is a Colorado Estate Tax form.

1 PDF editor e-sign platform data collection form builder solution in a single app. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. PO Box 17087 Denver CO 80217-0087 Use.

Until 2005 a tax credit was allowed for federal estate. DR 0253 - Income Tax Closing Agreement. The filing of the bankruptcy estates tax.

Form DR 1210 is a Colorado Estate Tax form. DR 1830 - Material. DR 1083 - Information with Respect to a Conveyance of a Colorado Real Property Interest.

Residential Properties Specific Forms For Charitable-Residential Properties. Or 500000 if filing jointly -- will be available in an amount equal to the property tax credit they qualified for on their 2021 Illinois returns up to. Ad Download Or Email Form 106 More Fillable Forms Register and Subscribe Now.

Annual Statement of Property Forms. Nonresidents of Colorado who need to file income taxes in the state need to file Form 104PN. DR 1210 - Colorado Estate Tax Return.

Application forms are available from the Colorado Department of Military and. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

Statement 4A would be true if not. Property Taxation - Declaration Schedules. TaxColoradogov Page 1 of 2 Colorado Account Number CAN FEIN or SSNITIN Change Main Address Mailing Address Physical Address Both.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. State residents who. DR 0900F - Fiduciary Income.

Neither I nor my spouse is receiving the senior citizen or the disabled veterans property tax exemption on any other property in Colorado. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000. Form 104EP - Estimated.

DR 0104EE - Colorado Easy Enrollment Information Form. DR 0900F - Fiduciary Income Payment Form. DR 1102 - Address or Name Change Form.

1313 Sherman STG 419.

What Is Schedule C Tax Form Form 1040

Contract Summary Timeline Is A Lifesaver At Closing Real Estate Marketing Plan Real Estate Checklist Real Estate Contract

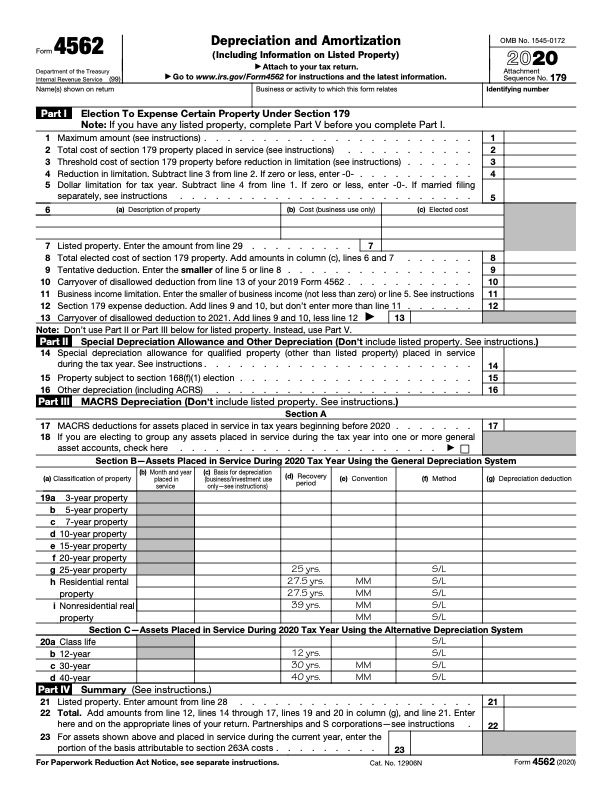

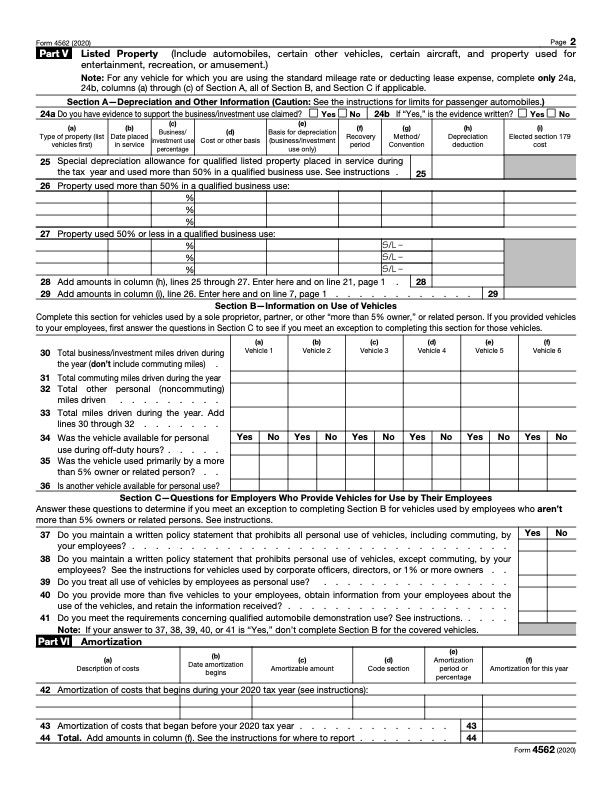

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

Tax Form Templates 5 Free Examples Fill Customize Download

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Understanding The 1065 Form Scalefactor

1977 Quebec Tax Form Partial Tax Forms Tax Partial

How To File Taxes For Free In 2022 Money

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting

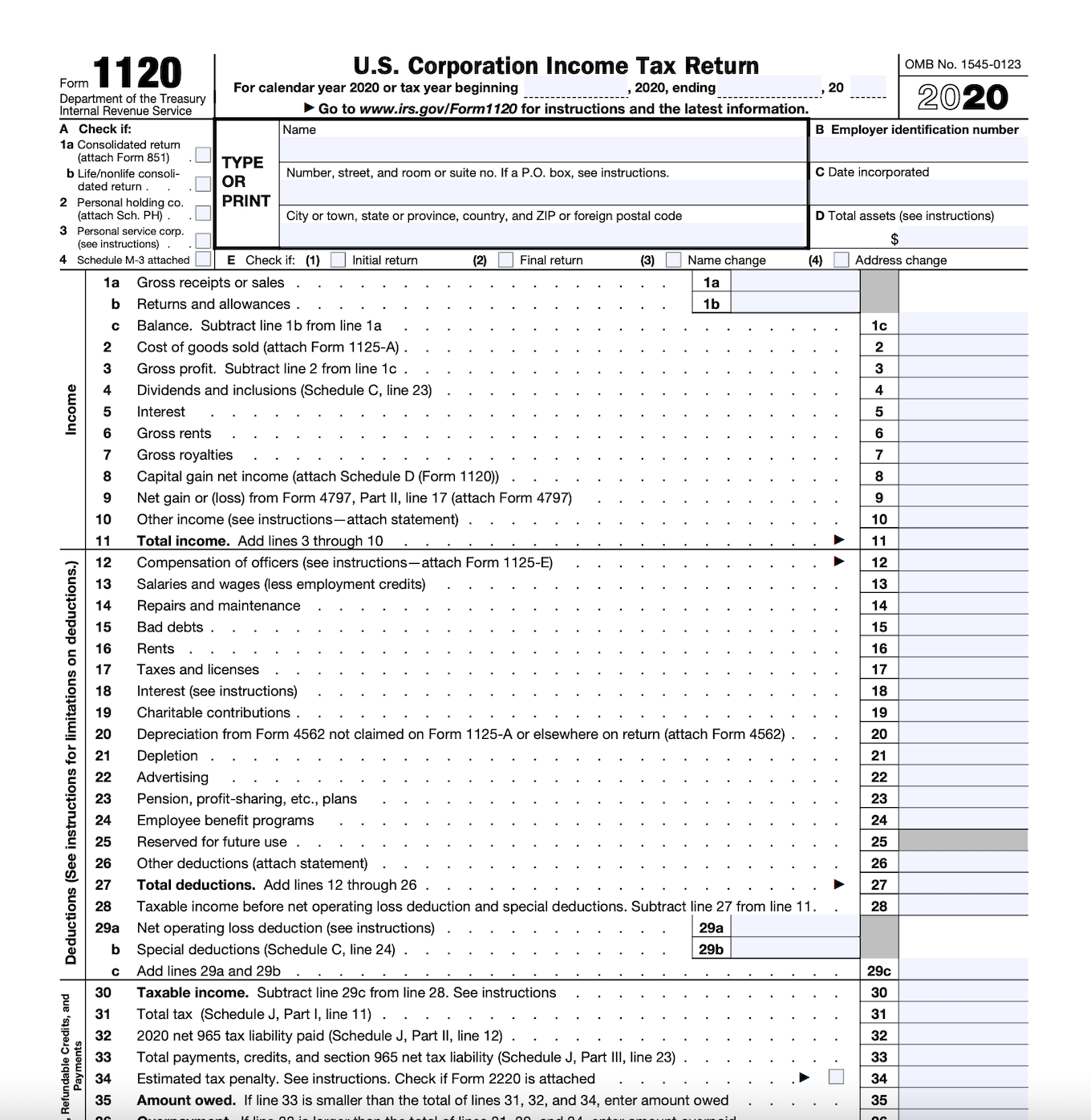

Form 1120 How To File The Forms Square

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Do I Find Last Year S Agi Income Tax Return Turbotax Adjusted Gross Income

How To Fill Out Form 1065 Overview And Instructions Bench Accounting